This article shows how important it is to look at both parents’ after-tax incomes when calculating child support. Let’s take the hypothetical example of John and Sue.

- John and Sue have one child.

- They share parenting time equally and they equally share some child expenses, so they want to divide their combined after-tax income 50/50.

- John earns $60,000 per year.

- Sue earns $20,000 per year.

- Their combined gross income is $80,000 per year.

First Try: Guideline Child Support Formula

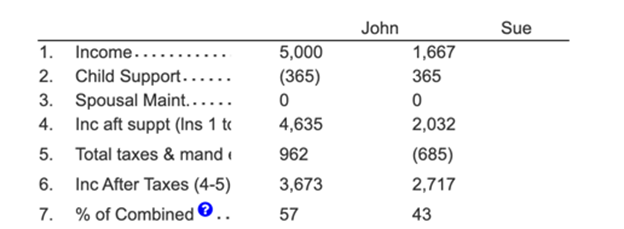

John and Sue’s mediator calculates child support under their state’s formula. The formula child support amount is $365 per month.

We will be using Family Law Software in the analysis that follows, but you don’t need the software to understand the point.

In Family Law Software, the mediator then clicks Analysis > Support Impact and prints the result.

Line 7 shows that John will have 57% of the total after-tax income and Sue will have just 43%. Because their goal is to share their income equally, the state child support amount doesn’t quite work for them.

Note: Line 5 of the report shows the total taxes that each party will pay. For Sue, her credits are more than her tax, so the IRS is paying her! (This is typical for people in Sue’s income range.)

Note also: Line 6 of the report shows the dollar amount each person has available to spend after taxes per month.

Second Try: John’s and Sue’s Child Support Calculation

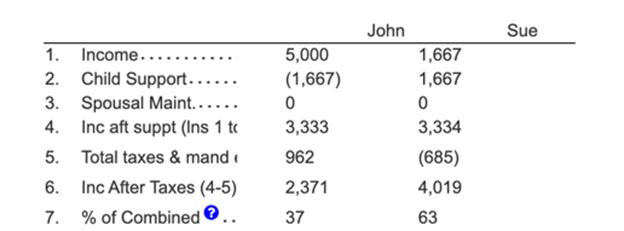

John and Sue did a calculation based on their gross incomes, without considering taxes, and found that support should be $1,667 per month.

Here’s how they did it:

John: $60,000

Sue: $20,000

TOTAL $80,000/2 = $40,000 EACH

Sue income $20,000

Child support $20,000

TOTAL $40,000

And $20,000 of child support per year is $1,667 per month.

The mediator entered that in the software on the “Enter Data > Child Support > Child Support to Use” section.

The mediator went to Analysis > Support Impact again.

Uh oh!

John and Sue realize that when they calculated support on their own, ignoring tax, they ended up with Sue having two-thirds of the income and John having just one-third, as reflected on Line 7 of the report.

Considering taxes is important!

The Third Time’s a Charm: Getting to Even

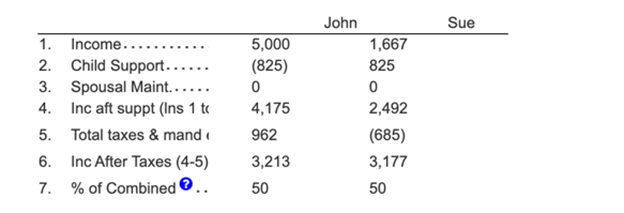

John and Sue finally ask the mediator to use Family Law Software to help come up with an amount of child support that will equalize total after-tax income.

The mediator tries different amounts and quickly arrives at $825 per month.

Success!

John and Sue have the result they are seeking, thanks to their mediator, who understands about looking at incomes on an after-tax basis.

Related Content

2021 Tips: Child Support and the Child Tax Credit

The American Rescue Act introduced dramatic changes in the Child Tax Credit, the Child Care Credit, and the Earned Income Credit – but only for 2021.

The Tax Trap in Exactly Equal Parenting

If the parties have agreed to exactly equal parenting, and the lower-income parent pays the child care expense, neither parent would be eligible to claim the child care credit. Can you avoid this tax trap?